Disruptors:Talent Crisis? What Talent Crisis?

…Growth Can Follow | Jody Padar: Build a Practice that Works for You, Not Vice-Versa | Ira Rosenbloom: With M&A, Nobody Wants a Fixer-Upper | Peter Margaritis: The Power Skills…

…Growth Can Follow | Jody Padar: Build a Practice that Works for You, Not Vice-Versa | Ira Rosenbloom: With M&A, Nobody Wants a Fixer-Upper | Peter Margaritis: The Power Skills…

Try for a 10-15% margin.

The Disruptors

With Liz Farr

Brandon Hall says that the reason accountants have such long and grueling busy seasons is that “firms try to make way too much money at tax prep.” Firms don’t have enough capacity to deliver on services, so everyone – including the partners – ends up working a ton of hours.

MORE PODCASTS and VIDEOS: James Graham: Drop the Billable Hour and You’ll Bill More | Karen Reyburn: Fix Your Marketing and Fix Your Business | Giles Pearson: Fix the Staffing Crisis by Swapping Experience for Education | Jina Etienne: Practice Fearless Inclusion | Bill Penczak: Stop Forcing Smart People to Do Stupid Work | Sandra Wiley: Staffing Problem? Check Your Culture | Scott Scarano: First, Grow People. Then Firm Growth Can Follow | Jody Padar: Build a Practice that Works for You, Not Vice-Versa |

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Because partner pay isn’t included in payroll, the margin on tax prep is likely much worse than the 30-35% that shows up on the income statement. Hall’s target for the 2024 filing season is just 10-15% margin on tax prep.

Safety’s knowing you can pay the bills. Purpose is knowing there’s something more.

The Disruptors

With Liz Farr

Amber Setter, the chief enlightenment officer for Conscious Public Accountants, started out as a Type A overachiever CPA, but after a few busy seasons, she realized that she “didn’t want to be an accountant anymore.”

MORE PODCASTS and VIDEOS: Blumer CPAs: Move Leaders Out of Client Service | James Graham: Drop the Billable Hour and You’ll Bill More | Karen Reyburn: Fix Your Marketing and Fix Your Business | Giles Pearson: Fix the Staffing Crisis by Swapping Experience for Education | Jina Etienne: Practice Fearless Inclusion | Bill Penczak: Stop Forcing Smart People to Do Stupid Work | Sandra Wiley: Staffing Problem? Check Your Culture | Scott Scarano: First, Grow People. Then Firm Growth Can Follow | Jody Padar: Build a Practice that Works for You, Not Vice-Versa | Ira Rosenbloom: With M&A, Nobody Wants a Fixer-Upper | Peter Margaritis: The Power Skills Every Accountant Needs | Joe Montgomery: Find the Sweet Spot of the Right Clients, Right Services and Right Prices | Marie Green: Your Bad Apples Are Ruining You | Megan Genest Tarnow: Hire for Curiosity Rather Than Compliance |

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Today she’s an executive leadership coach for accountants, helping them transform their lives and careers.

…Read it closely and adapt it to your practice. You will be happier, more relaxed and richer for doing so.” – Peter A. Weitsen, CPA, PFS, Partner, WithumSmith+Brown Why This…

Six questions to ask, plus a real-world example.

By Ed Mendlowitz

202 Questions and Answers: Managing an Accounting Practice

QUESTION: I suspect that my partner has “maxed out” and cannot grow further, which will retard our growth. What can I do or how can I deal with this?

MORE: 47 Types of Business Valuation to Provide | Referral Fee? Forget It | How Much Is Your Tax Practice Worth? | Merge in Lower-Priced Work without Losing Out

Exclusively for PRO Members. Log in here or upgrade to PRO today.

RESPONSE: This is a frequent question, and sometimes it is the person asking it who has “maxed out.” But sometimes it is the partner or a key staff who wants to be made a partner.

READ MORE →

Find your fit.

By CPA Trendlines Research

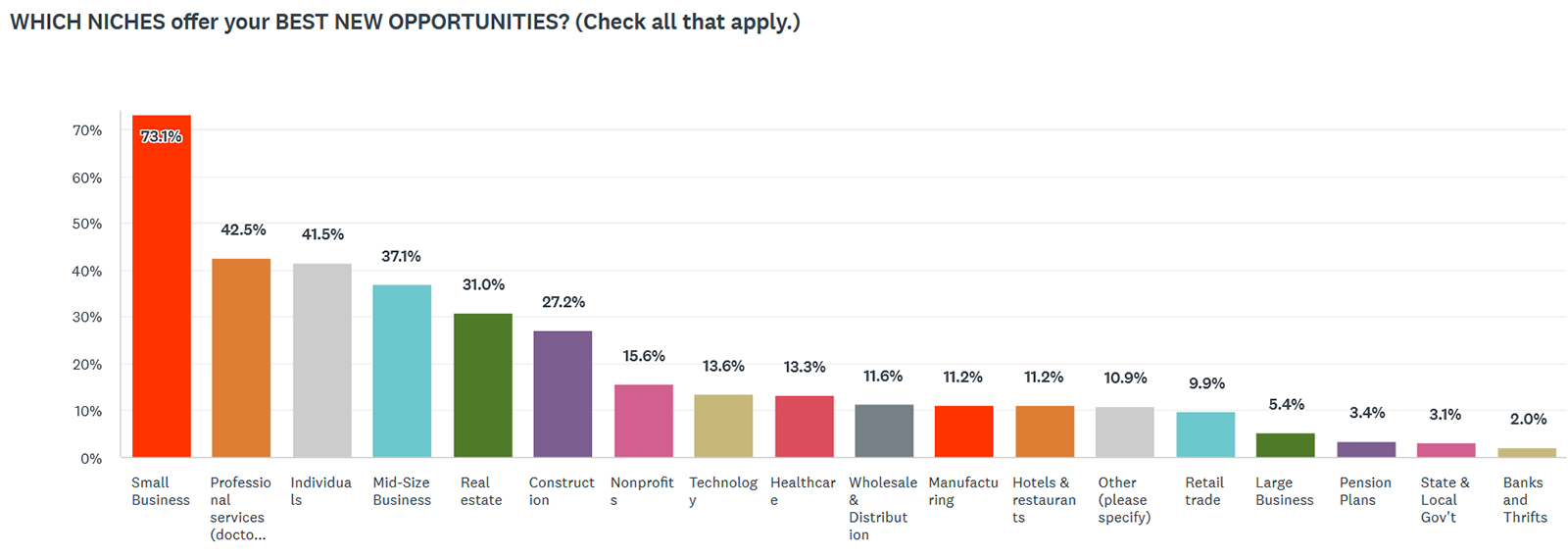

Which niches offer the best opportunities for new business next year?

MORE: Women-Owned Businesses Upbeat but Need Help | SURVEY: 42% of Accountants Turn Away Work Over Staff Shortages | Ethics on Sustainability Puzzle Some Accountants | Accountants to the Rescue as Startups Struggle | Talent Gap Widening: Be Very Scared | Accountants Hopeful, Concerned and Confused about AI | Looking for Recent Grads? Good Luck | CPA Biz Is Booming, But for How Long?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

According to early results from the CPA Trendlines Outlook 2024 Emerging Issues, Opportunities and Trends survey, America’s accountants see more business in the niches they know best – the sectors where they already have experience and proven competency.

READ MORE →

Packages make the process easier.

By August J. Aquila

Price It Right: How to Value Accounting Services

While most accountants and consultants struggle with trying to sell their services to the next new client, there are two ways to get new and additional business without moving too far out of your comfort zone.

MORE: The Four Steps of Your Personal Marketing Process | Eleven Marketing Strategies for Smaller Firms | Five Questions for Developing Your Marketing Plan | You Only Have Four Strategies | The Damage That Traditional Fee Methods Do | Ten Keys to Marketing Success

Exclusively for PRO Members. Log in here or upgrade to PRO today.

One way is cross-selling and the other is upselling. Cross-selling is persuading a client to buy other products or services to complement a purchase. Upselling encourages a buyer to purchase a higher-end, more expensive product or service.

READ MORE →

…Peter Margaritis: The Power Skills Every Accountant Needs | Joe Montgomery: Find the Sweet Spot of the Right Clients, Right Services and Right Prices | Marie Green: Your Bad Apples…